Mn Renters Rebate E File – Renting your Minnesota home could qualify you for the MN Renters Rebate. Minnesota families can receive financial assistance through this property tax refund. Before you submit your application, there are many things you need to know. These include the deadlines and how much you are eligible to claim.

MN Renters’ Tax Refund

If you are renting a home, you may be eligible for a MN Renters’ Property Tax Refund. The government program offers a refund of up to 654 per household. The average refund is around $900. Renters can qualify for this refund if their household income falls below certain guidelines.

You must have a valid social safety number or an individual tax identification number to be eligible. If you reside in a rental property, you can file. You have until August 15, 2023, to file a claim. The Department of Revenue provides information on refunds, including the Where’s My Refund tool.

Minnesota renters can receive a property tax refund depending on their income and number of dependents. This program is intended to help renters and homeowners who are unable to pay property taxes. It also works for renters who are living in a nursing home or assisted living facility. In addition, renters who are living in a different state and paying rent in Minnesota may qualify for a property tax refund.

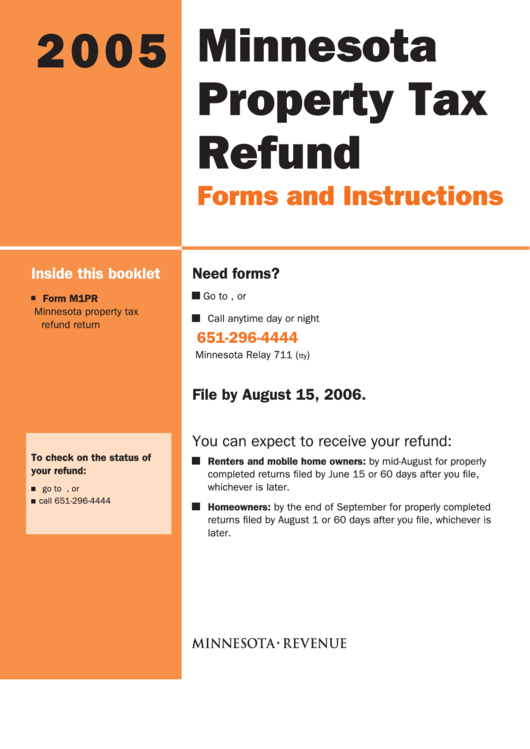

MN M1PR returns are due by August 15. If you file your return within the deadline, you will receive a refund before the end of the calendar year. You may be able to get your refund quicker if you file your return electronically. The Minnesota Department of Revenue provides more information about the M1PR program and the refund process.

Deadlines for claiming a refund

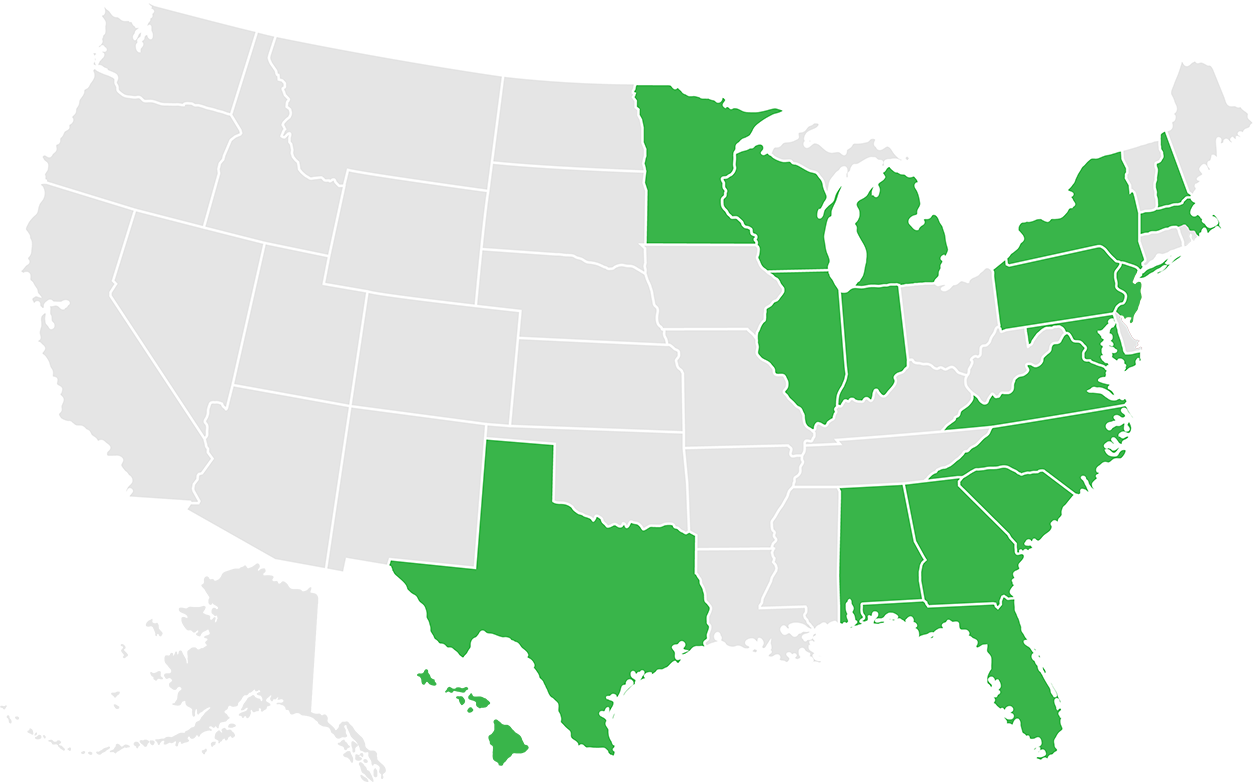

Renting a Minnesota property could qualify you for a refund of property taxes. The Minnesota Department of Revenue offers two refund programs for homeowners and renters. The income of the household and property taxes paid in Minnesota determine which program you can claim. Eligibility for either program is determined by how long you have lived in the state.

Minnesota renters can file for a refund by submitting Form M1PR and a Certificate of Rent Paid, which your landlord should have given you in January. Additional income earned from sources other than tax can be declared. Visit the Department of Revenue website to find out if your income qualifies for a refund.

Minnesota Department of Revenue reminds homeowners, renters, and tenants to file for property tax refunds by the August 15 deadline. The refund season lasts for two years. Homeowners and renters who meet income requirements may claim up to $700 in property taxes. Renters who request a refund usually receive $654.

If you miss the August 15 deadline, you can still claim a refund by filing Form M1PR and waiting up to two weeks. However, if you miss the deadline for filing, you cannot claim a refund for the 2016 year.

Is income a factor in determining eligibility for a refund?

Minnesota renters are eligible for a partial refund of property taxes, as long as they meet certain income guidelines. In general, renters with incomes up to $62,960 qualify for a refund. Renters who earn more than this amount will be eligible for a refund up to 65 per cent of the excess property taxes. The average Minnesota renter will get $806 for the payment of nearly 40% of property tax.

The Minnesota renters refund program is intended to provide tax relief to low and moderate-income families. The program also benefits Black and Hispanic families, which are particularly affected by systemic racism and economic hardship. As a result, these groups are disproportionately affected by property tax increases.

Make sure to include information about roommates on your lease. You may also be eligible for an advance premium tax credit if you are a student. It is important to list all roommates in your lease.

Minnesota renters refunds will only be available to Minnesota residents. However, residents from other states may also be eligible for the Minnesota Renters Property Tax Refund. This tax credit is based on your household income and Minnesota property tax paid.