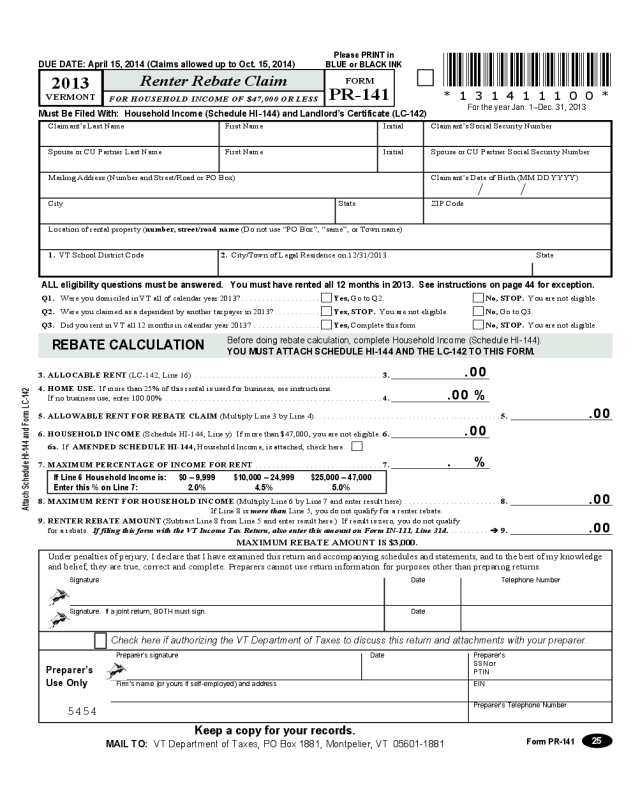

File My Renters Rebate Online – The Vermont Renter Credit, also known as the renter rebate, is a tax credit that allows qualifying renters to get money back on their rent. To qualify, a renter must live in Vermont for the full tax year, or for six consecutive months. The renter credit is also available if the renter does not file an income tax return. You can check with Vermont Department of Taxes to find out more about eligibility.

This program is intended to make renting affordable. The renter will not have to pay full rent. Instead, they will be eligible for a credit that is based on the area’s fair market rent. Fair market rent is determined by the U.S. Department of Housing and Urban Development. In addition, a renter will be able to claim the credit for more than one person in the household. Furthermore, the claimant no longer needs a Landlord Certificate, but the landlord must submit one to get credit.

The renter’s credit is a tax credit for taxpayers who rent their primary residence. Each state has its own rules, so be sure to read your state’s tax code before filing your annual tax return. Renters must be legally resident in the state they reside, file a tax return and pay their fair share. The credit is only available for primary residences. Building owners also need to pay taxes on the building to be eligible for the credit.

Eligibility

A few criteria determine whether you are eligible for the File Renters Rebate program. Renters must reside in Pennsylvania to be eligible for the File Renters Rebate program. For another, they must have paid their property taxes for the previous calendar year. And finally, they must have been living in the home for at least one day in the year that they apply for the rebate.

The renter’s income may determine whether they are eligible for a rebate or a tax deduction. The rules and conditions for eligibility vary from State to State, so it’s important to check your state’s requirements. For example, if you are a single person earning more than $45,000 per year, you are not eligible for this program.

You may be eligible for the File Renters Rebate if you meet certain income requirements. The government-run rebate program is available to those who earn less that $20,000 annually. A yearly rebate up to $700 may be available for those who meet these requirements. You can apply for the rebate by visiting the Department of Revenue website.

Claim process

You need to follow these steps if you want to claim a renters rebate. These steps will make it easier to get your money quicker. Document your loss and damage as accurately as you can. Keeping a copy of the police report and receipts for any immediate expenses will help you with your claim. These steps will also decrease the chances of your claim being delayed or not receiving the full settlement amount.

Online application is possible if you are eligible for the renters rebate. You can file your claim online at the Department of Revenue. You can also fill out a paper claim as well. Once your claim is approved, you’ll be notified by the department.

Electronic filing

Electronic filing is one of the ways to streamline court procedures. This new service allows tenants and landlords to file landlord tenant lawsuits online. These documents include complaints about landlord tenants failing to pay rent and warrants for restitution. In addition, landlords and tenants can file motions and other documentation online.

To qualify for the renters rebate, applicants must meet certain requirements. First, they must have proof of rent payment. You can either have a signed rent certificate from the landlord or agent or a rent receipt. Electronic filing is the preferred method of submitting these documents. The refund will be issued within 60 days of filing.

Second, they must have rented or owned a home in Pennsylvania. Third, they must have paid their property taxes prior to filing their application. They must also have paid rent in the previous calendar year. Renters must have paid their property taxes if they rent. However, this doesn’t mean that you can’t claim a renters rebate if you qualify for Social Security Disability benefits.