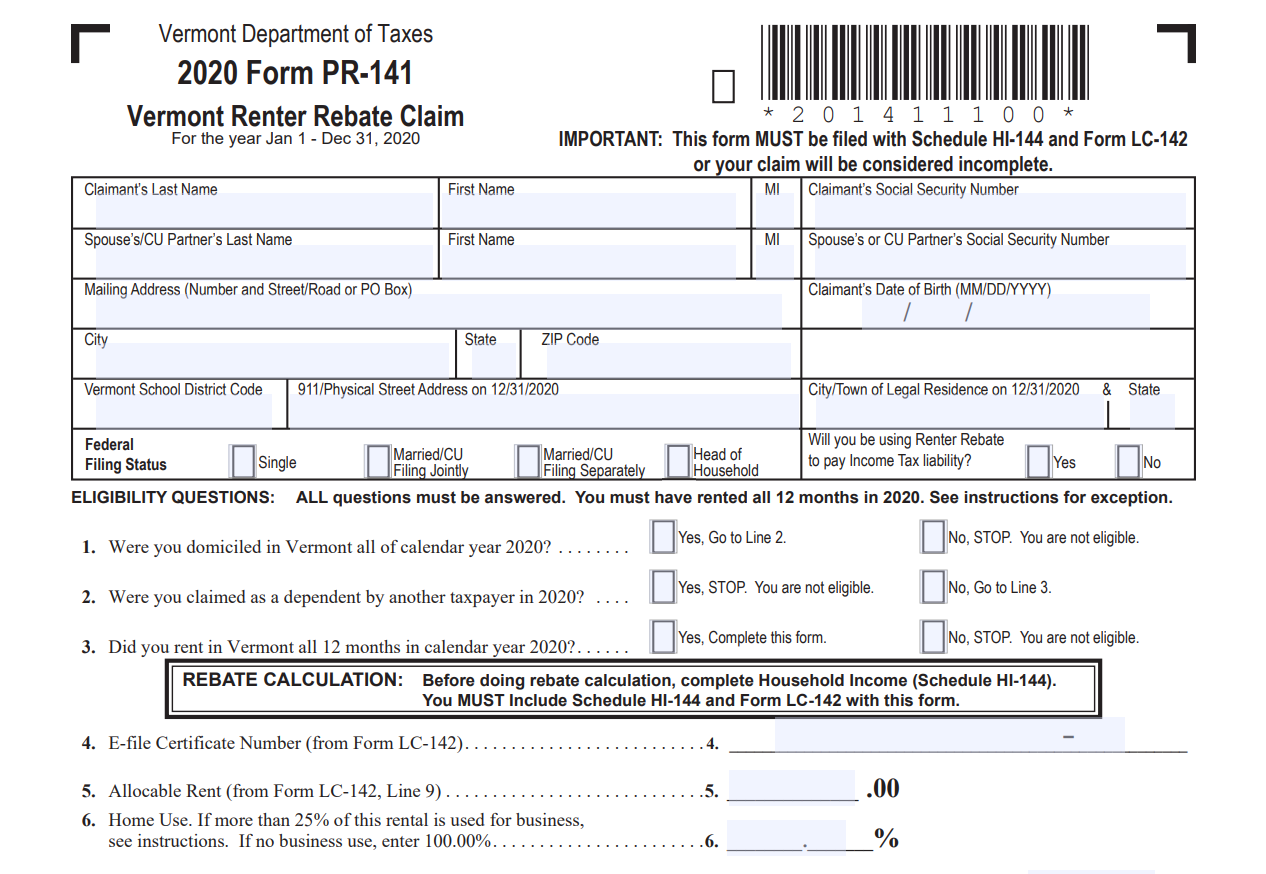

Renters Rebate Vermont – The state of Vermont is making substantial changes to its Renters Rebate program. These changes will go into effect for the 2021 tax year and the income tax filing season of 2022. First of all, there will be a new Landlord Certificate form. This will replace the Landlord Certificate form that was previously required to claim the Rebate. Each rental property must complete the Landlord Certificate, which can be filed through myVTax.

VERAP rent payments affect renter credit

VERAP can pay back rent, prospective rent, and 18 months of back rent. The program will also pay any unpaid rent that remains after April 1, 2020. If you want to use VERAP to pay your back rent, you must apply through the housing program. To apply, you must fill out a tenant application and a landlord application.

Upload the court paperwork before you submit the application. This court document, called the Summons and Complaint, is part of the application. You can upload it to a computer or mobile phone. After you have uploaded all the documents, submit your application online.

The last date for receiving VERAP assistance is December 31, 2022. However, if you apply early, you can still get assistance. The program will still cover a portion of the rent, and it can pay the landlord’s attorney fees. If you’re eligible, you’ll be able to get your utilities paid.

VERAP rent payments won’t affect your renter credit, but you should not include them in your gross income. VERAP rent payments are not taxable income. However, landlords are liable. A Form 1099 will be sent to the utility provider. For more information on VERAP, visit the IRS web page.

COVID-19 related sales/revenue losses may apply for additional funding

You may be eligible to receive additional funds through the state’s COVID-19 rehabilitation program if you have a Vermont rental property. Interested Vermonters should submit pre-applications for the program. The application deadline and the start date for additional funding will be communicated to applicants.

The Department of Public Utilities in the state offers resources to assist customers affected by COVID-19. This includes ERAP, RAFT and more. The Massachusetts Homeowner Assistance Fund provides additional funding for homeowners who are eligible for it. This fund helps qualified homeowners pay their utility bills. The Division of Banks can help homeowners who are in foreclosure within seven days of a storm.

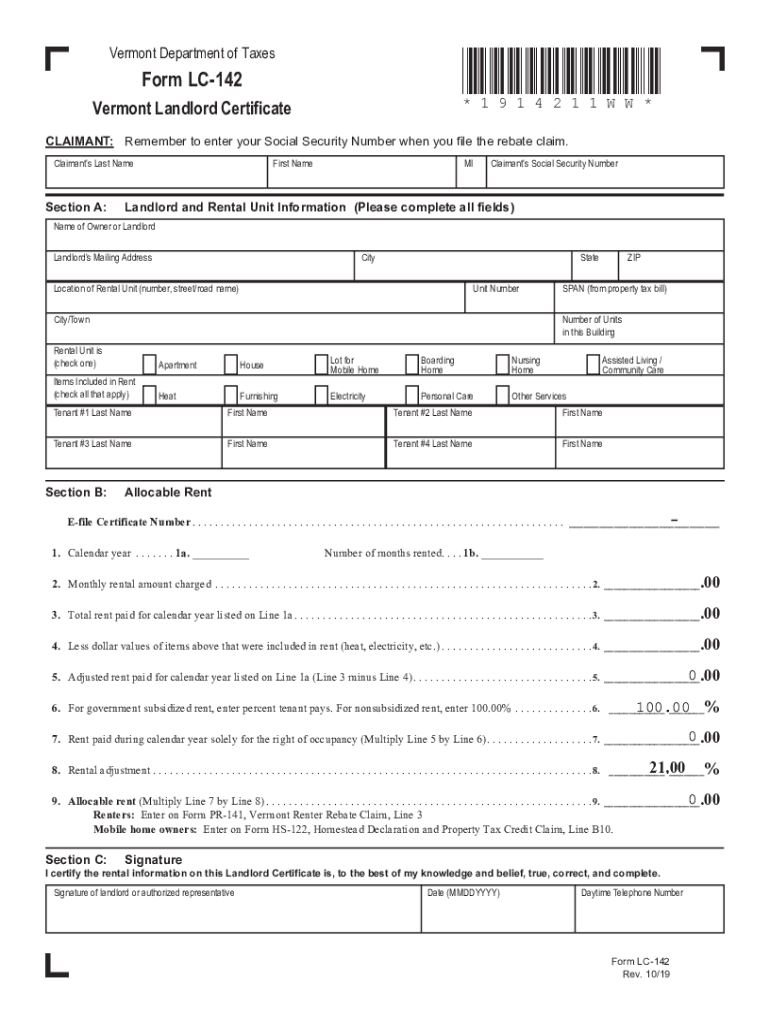

LRC-140 Landlord Certificate required for landlords

The Landlord Certificate is a mandatory form for landlords in Vermont. This form is filed each year by January 31 and is used to let the state know about subsidized rent and renters. It includes information about the owner, mailing address, physical location, school parcel account number, and number of rental units. It should include information about the owner, physical location, school parcel account number, and number of rental units.

A landlord must fill out this form for each property. The SPAN must be recorded by a Landlord for each property they have in the state. It can be found on the property tax bill. This information can be found on the Department of Revenue website. The rent that is reported must be net rent (net rent is the rent the tenant pays to a landlord for the right of occupancy), not the room charge or utilities.